We have also designed an online portal to make it efficient for brokers to collect documents from clients. A good collaboration between a mortgage broker and a loan processor can see a mortgage broking business grow to new heights.

What is Connective Mercury?

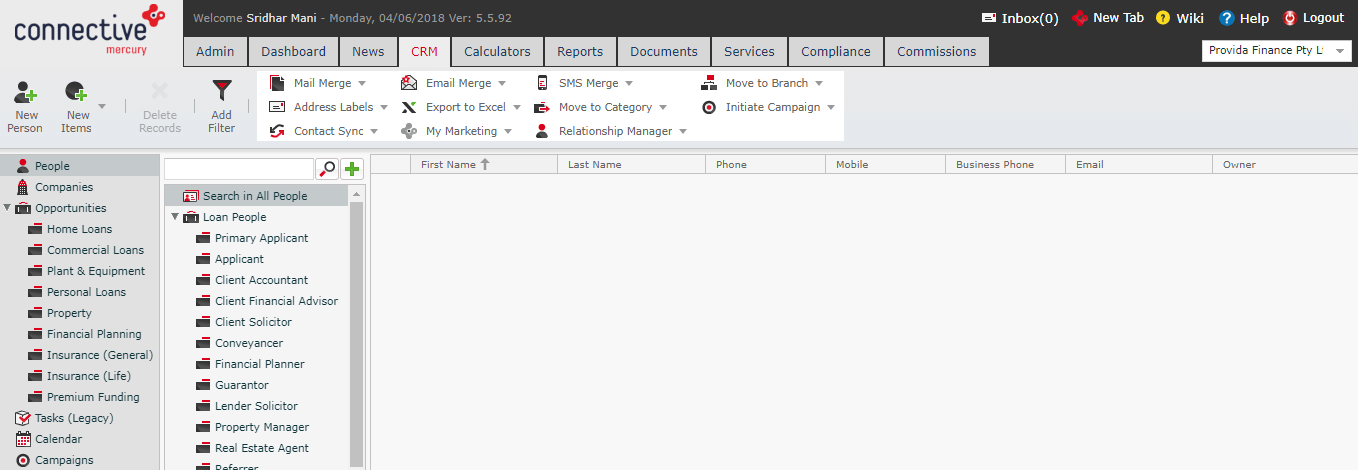

Connective is a website or program which acts a repository where information, financial policies and related documents or items and contents are collected and stored. It’s a transparent application helping brokers aggregate or speed up the business by displaying them or linking them.

Why is Connective Mercury used?

- Connective has made some of the work easy for brokers to access the right resources with effective linking to related information.

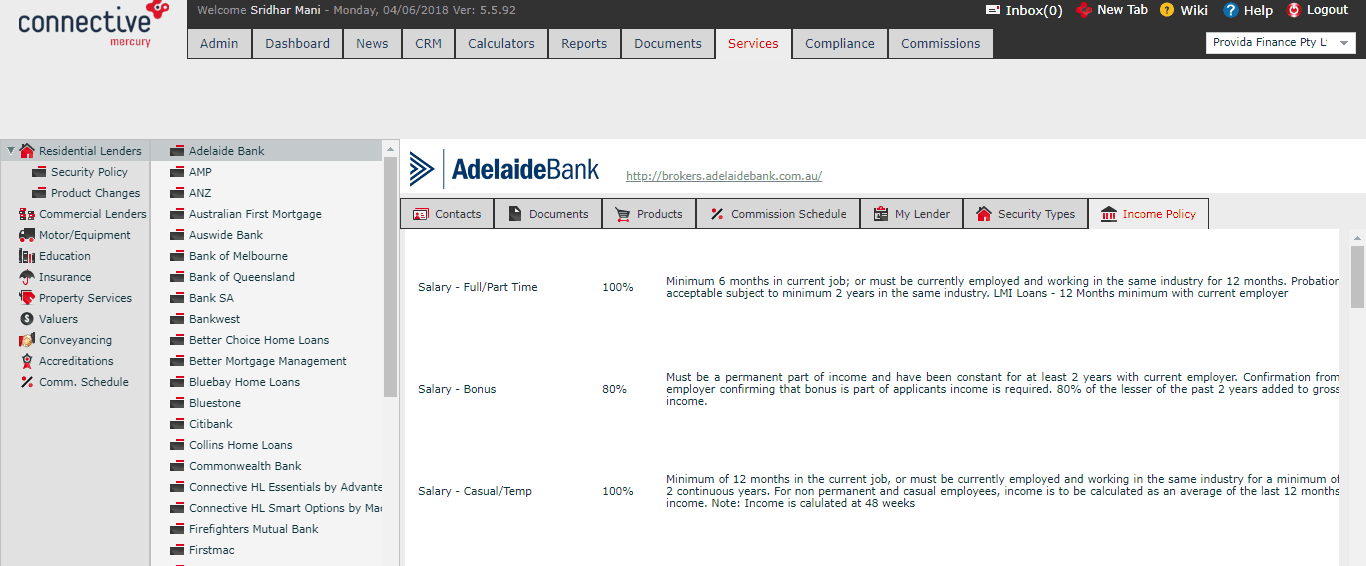

- It also provides up-to date lender requirements to the Brokers to keep abreast of any changes in the lending policies.

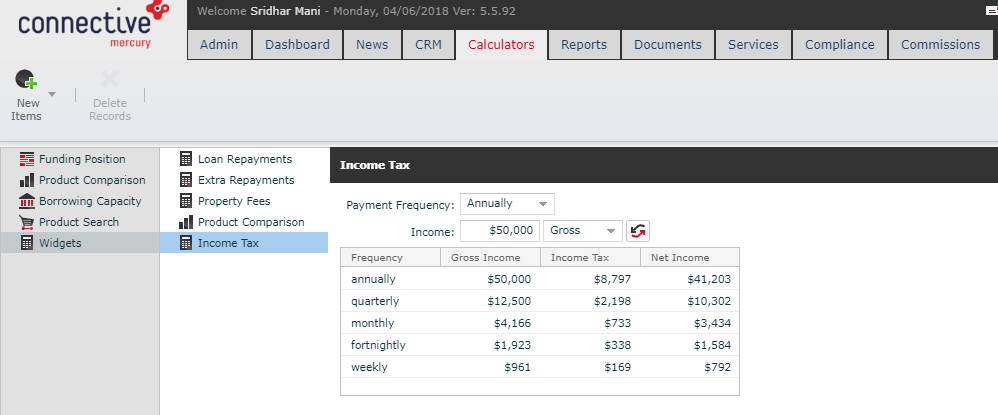

- Stores information related to loan, borrowers, tax, insurance etc

- It makes serviceability calculations easy for the brokers by providing information related to calculation policies.

- Interactive security guidelines are stored and linked for broker use.

- It provides Federal, State guidelines to be followed for Credit Lending.

- Status of the loan is interacted through the application with the related banks.

- Effective interaction enabled across all channels of Banking.